Praise Sabo-Wada

A data analyst with vast amounts of technical knowledge and experience.

View the Project on GitHub Simzshots/Bank-Churners-and-Video-Game-Sales-Data-Analysis

Bank Churners and Video Game Sales Data Analysis

INTRODUCTION

In the realm of banking, keeping customers satisfied and preventing them from leaving is crucial. This report dives into a dataset focused on customers who have stopped using the credit card services of a bank. The goal is to not only predict potential churn but also understand the factors that contribute to it, using a mix of predictive modelling and statistical methods. Also, comprehending sales trends and industry influencers is crucial for publishers and developers alike in the ever-changing video game market. An in-depth analysis of a video game sales dataset is also conducted in this research, including a wide range of factors including sales in North America, Europe, and worldwide markets as well as platform, genre, publisher, and more.

BANK CHURNERS DATASET OVERVIEW:

The dataset contains a bunch of information about customers, including their age, gender, marital status, credit limit, and more. I am digging into this data to figure out why customers decide to stop using their credit card services. This report is structured to guide you through my journey. I start by looking at the big picture through data exploration. Then, I’ll build a tool to predict potential churn. Simultaneously, I’ll use simple statistical tests to uncover more insights about why customers might be leaving. I aim to provide the bank’s management with clear and practical information, helping them make informed decisions to improve customer satisfaction and retention. The dataset is a bank dataset which contains information about customers of a bank, including their age, gender, marital status, credit limit, and more as well as their attrition status. The data set has 9 variables, and 10,127 observations so parametric tests would be used to investigate the dataset without normality checks because the sample size is large (n>30). I am digging into this data to determine why customers stop using their credit card services.

Importing the Bank Churners dataset (Dataset 1)

Note: The dataset was cleaned by removing not needed columns using Excel.

library(readr)

Bank <- read.csv("BankChurners.csv")

#Checking the contents of the data

head(Bank)

Output

| Attrition_Flag | Customer_Age | Gender | Dependent_count | Education_Level | Marital_Status | Income_Category | Card_Category | Credit_Limit | Total_Revolving_Bal | Total_Trans_Amt |

|---|---|---|---|---|---|---|---|---|---|---|

| Existing Customer | 45 | M | 3 | High School | Married | $60K - $80K | Blue | 12691 | 777 | 1144 |

| Existing Customer | 49 | F | 5 | Graduate | Single | Less than $40K | Blue | 8256 | 864 | 1291 |

| Existing Customer | 51 | M | 3 | Graduate | Married | $80K - $120K | Blue | 3418 | 0 | 1887 |

| Existing Customer | 40 | F | 4 | High School | Unknown | Less than $40K | Blue | 3313 | 2517 | 1171 |

| Existing Customer | 40 | M | 3 | Uneducated | Married | $60K - $80K | Blue | 4716 | 0 | 816 |

| Existing Customer | 44 | M | 2 | Graduate | Married | $40K - $60K | Blue | 4010 | 1247 | 1088 |

SUMMARY OF THE DATA SET

summary(Bank)

Output

| Attrition_Flag | Customer_Age | Gender | Dependent_count | Education_Level | Marital_Status | Income_Category | Card_Category | Credit_Limit | Total_Revolving_Bal | Total_Trans_Amt |

|---|---|---|---|---|---|---|---|---|---|---|

| Existing Customer | 45 | M | 3 | High School | Married | $60K - $80K | Blue | 12691 | 777 | 1144 |

| Existing Customer | 49 | F | 5 | Graduate | Single | Less than $40K | Blue | 8256 | 864 | 1291 |

| Existing Customer | 51 | M | 3 | Graduate | Married | $80K - $120K | Blue | 3418 | 0 | 1887 |

| Existing Customer | 40 | F | 4 | High School | Unknown | Less than $40K | Blue | 3313 | 2517 | 1171 |

| Existing Customer | 40 | M | 3 | Uneducated | Married | $60K - $80K | Blue | 4716 | 0 | 816 |

| Existing Customer | 44 | M | 2 | Graduate | Married | $40K - $60K | Blue | 4010 | 1247 | 1088 |

| Variable | Length | Min | 1st Qu. | Median | Mean | 3rd Qu. | Max | Class | Mode |

|---|---|---|---|---|---|---|---|---|---|

| Attrition_Flag | 10127 | character | character | ||||||

| Customer_Age | 10127 | 26.00 | 41.00 | 46.00 | 46.33 | 52.00 | 73.00 | character | character |

| Gender | 10127 | character | character | ||||||

| Dependent_count | 10127 | 0.000 | 1.000 | 2.000 | 2.346 | 3.000 | 5.000 | character | character |

| Education_Level | 10127 | character | character | ||||||

| Marital_Status | 10127 | character | character | ||||||

| Income_Category | 10127 | character | character | ||||||

| Card_Category | 10127 | character | character | ||||||

| Credit_Limit | 10127 | 1438 | 2555 | 4549 | 8632 | 11068 | 34516 | numeric | numeric |

| Total_Revolving_Bal | 10127 | 0 | 359 | 1276 | 1163 | 1784 | 2517 | numeric | numeric |

| Total_Trans_Amt | 10127 | 510 | 2156 | 3899 | 4404 | 4741 | 18484 | numeric | numeric |

The data set has no missing values with 11 variables and 10,127 observations so parametric tests would be used to investigate the dataset without normality checks because the sample size is large (n>30) and a Shapiro Test will not work because the sample size is >3,000.

ONE SAMPLE T-TEST

PROBLEM STATEMENT: The bank wants to know if the average age of their clientele is 45.

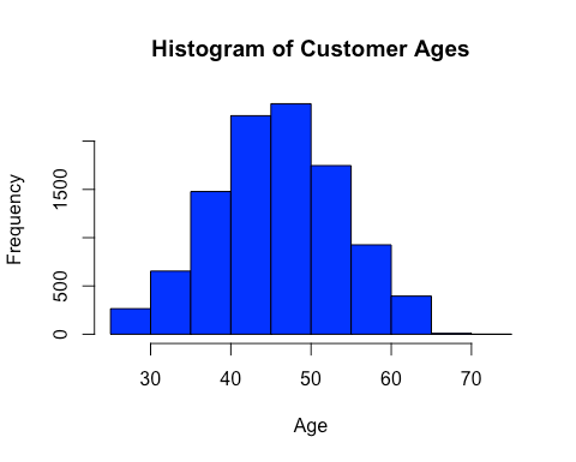

EXPLORATORY DATA ANALYSIS: Using a histogram to investigate the frequency of customer ages.

Histogram

hist(Bank$Customer_Age,xlab = "Age", ylab ="Frequency", main = "Histogram of Customer Ages", col = "blue")

Output

Inference: From the histogram, the majority of the clients are around 40-50 years old.

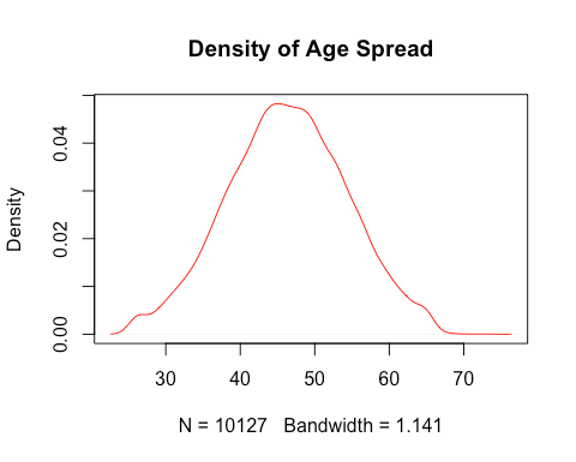

Density Plot and Boxplot

plot(density(Bank$Customer_Age), main = "Density of Age Spread", col="red")

Output

boxplot(Bank$Customer_Age, main = "Boxplot of Customers' Age", col = "red")

Output

AIM: I aim to use a one sample t-test to see if the mean customer age is statistically different from 45 at the 95% confidence interval.

ASSUMPTIONS:

- Null Hypothesis (H0): The average customer age is equal to 45.

- Alternate Hypothesis (H1): The average customer age is not equal to 45.

t.test(Bank$Customer_Age, mu=45)

Output

data: Bank$Customer_Age

t = 16.644, df = 10126, p-value < 2.2e-16

alternative hypothesis: true mean is not equal to 45

95 percent confidence interval:

46.16980 46.48212

sample estimates: mean of x 46.32596

RESULTS: After conducting the T-test, the t-statistic was 16.644 with a 95% confidence interval of 46.16980 to 46.48212 and the p-value was < 2.2e-16.

Inference: Since the t-statistic is not in the confidence interval and the p-value is less than the 0.05 significance level, I reject the null hypothesis and accept the alternate hypothesis that the average customer age is not equal to 45.

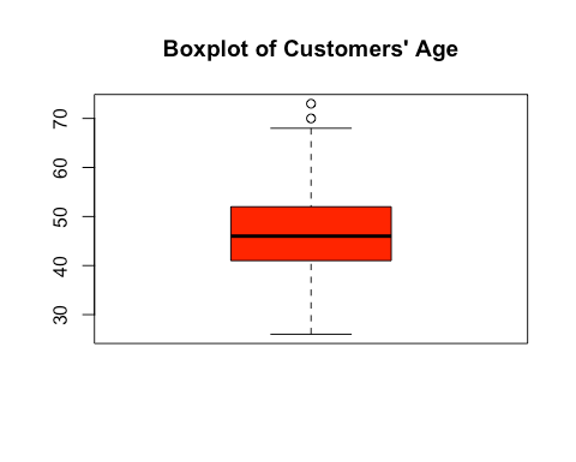

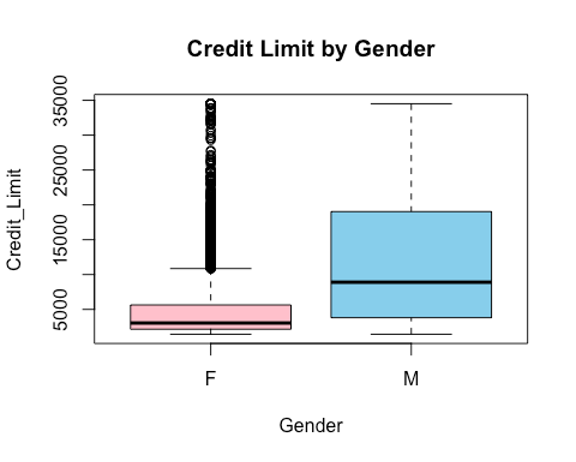

WELCH TWO SAMPLE T-TEST

PROBLEM STATEMENT: In exploring the credit dynamics within the customer base, a pertinent question arises: Do the credit limits of male and female customers differ significantly?

EXPLORATORY DATA ANALYSIS: Using a t-test to check if the credit limit of customers with respect to their genders are equal. Shapiro test failed to work because the sample size is too large (>3,000). To visualize the distributions of the credit limit of each gender and compare, box plots would be used.

boxplot(Credit_Limit ~ Gender, data = Bank, main = "Credit Limit by Gender", col = c("pink","skyblue"))

Output

bartlett.test(Bank$Credit_Limit ~ Bank$Gender)

Output

Bartlett test of homogeneity of variances

data: Bank$Credit_Limit by Bank$Gender

Bartlett’s K-squared = 2393.8, df = 1, p-value < 2.2e-16

Inference: From the box plots, it is noticeable that the credit limit of the female gender has some outliers which could affect the mean and the medians of the credit limits by gender are not equal which could imply that the means are not equal and they have unequal variances. But a parametric t-test will be used to further investigate the claim gotten from the box plots. Because the sample is large, i.e n>30 there would be no need to test normality before the t-test. Also, the Bartlett test shows that they have unequal variances.

AIM: I will be carrying out a two-sample t-test to check if the credit limits across both genders are equal at the 95% confidence interval.

ASSUMPTIONS:

- Null Hypothesis (H0): The credit limits of each gender are equal.

- Alternate Hypothesis (H1): The credit limits of each gender are not equal.

t.test(Bank$Credit_Limit ~ Bank$Gender, conf.level = 0.95)

Output

Welch Two Sample t-test

data: Bank$Credit_Limit by Bank$Gender

t = -45.052, df = 6773.7, p-value < 2.2e-16

alternative hypothesis: true difference in means between group F and group M is not equal to 0

95 percent confidence interval:

-7995.201 -7328.441

sample estimates:

mean in group F mean in group M

_5023.854 12685.675_

RESULTS: After conducting the T-test, the t-statistic was -45.052 with a 95% confidence interval of -7995.201 to 7328.441 and the p-value was < 2.2e-16.

Inference: Since the t statistic does not fall inside the confidence interval and the p value is way less than 0.05, we reject the null hypothesis that says the credit limit of customers with respect to their genders are equal.

ANOVA TEST

PROBLEM STATEMENT: In delving into the financial dynamics within the bank’s customer base, a critical inquiry emerges: Are the credit limits uniform across distinct card categories?

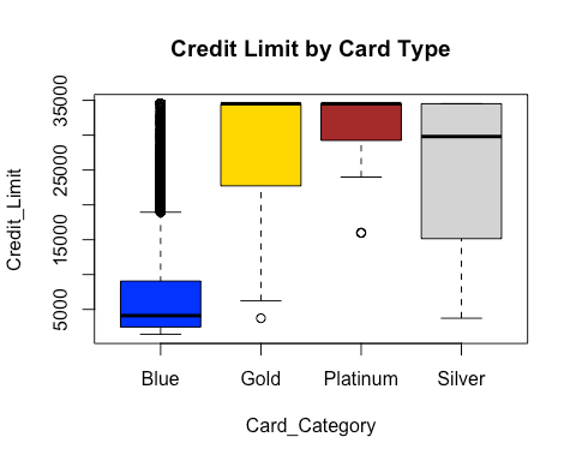

EXPLORATORY DATA ANALYSIS: Now, before using an ANOVA Test to check if the credit limit of the type of cards are equal, box plots would be used to visualize the distributions of the credit limits of the different card categories.

boxplot(Credit_Limit ~ Card_Category , data = Bank, main = "Credit Limit by Card Type", col = c

("blue","gold","brown","lightgray"))

library("lattice")

Output

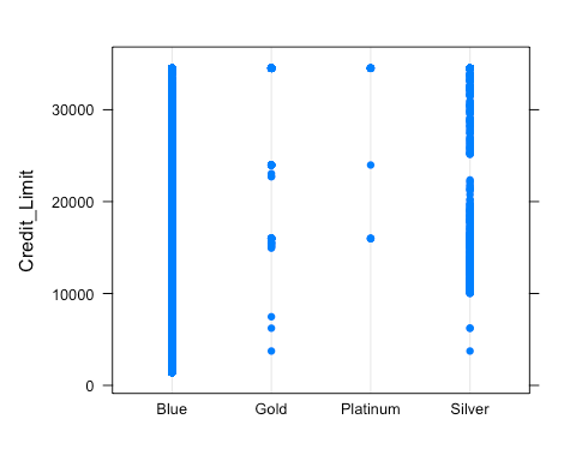

dotplot(Credit_Limit ~ Card_Category , data = Bank)

Output

bartlett.test(Credit_Limit ~ Card_Category , data = Bank)

Output

Bartlett test of homogeneity of variances

data: Credit_Limit by Card_Category

Bartlett’s K-squared = 68.069, df = 3, p-value = 1.106e-14

Inference: From the box plots, the blue card type has a lot of outliers and the median is quite far from the other card types. The gold and platinum card types have similar medians and the silver card type has a median closer to theirs but far from the median of the blue card type. Overall, from the plots, the card types do not have equal medians which could indicate that their means may not be equal. Also, the Bartlett test shows that they have unequal variances.

AIM: I aim to use an ANOVA test to investigate if the credit limits across distinct card categories are equal using the 0.05 significance level.

ASSUMPTIONS:

- Null Hypothesis (H0): The credit limit of each card category is equal.

- Alternate Hypothesis (H1): The credit limit of each card category is not equal.

oneway.test(Bank$Credit_Limit~Bank$Card_Category, var.equal = FALSE) #Using a Welch's ANOVA because their variances are not equal.

Output

One-way analysis of means (not assuming equal variances)

data: Bank$Credit_Limit and Bank$Card_Category

F = 867.07, num df = 3.000, denom df = 79.821, p-value < 2.2e-16

RESULTS: The F-statistic is 1232.1 and the p-value is < 2.2e-16.

Inference: Since the p value is very low (< the significance level 0.05), the null hypothesis that the credit limit of the different types of cards are equal will be rejected. Hence, accepting the alternative hypothesis that the different card categories have different credit limits.

LINEAR REGRESSION

CORRELATION

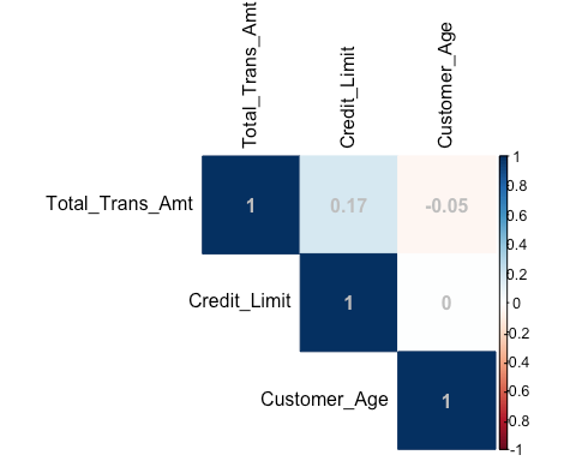

QUESTION: Is there a discernible correlation between customers’ credit limits, customer’s age and their total transaction amounts?

library(corrplot)

## corrplot 0.92 loaded

#First, a check for correlation between both variables

cormat<-cor(Bank[, c("Total_Trans_Amt", "Credit_Limit", "Customer_Age")])

corrplot(cormat, method = "color", type="upper", addCoef.col="grey",tl.col="black")

Output

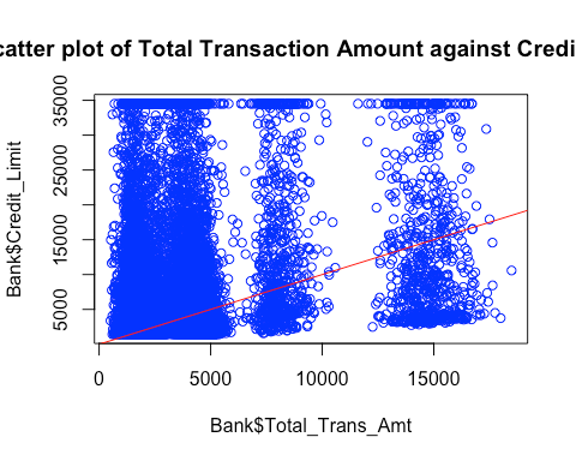

plot(Bank$Total_Trans_Amt,Bank$Credit_Limit, main = "Scatter plot of Total Transaction Amount against Credit Limit", col = "blue")

abline(a = 0, b = 1, col = "red")

Output

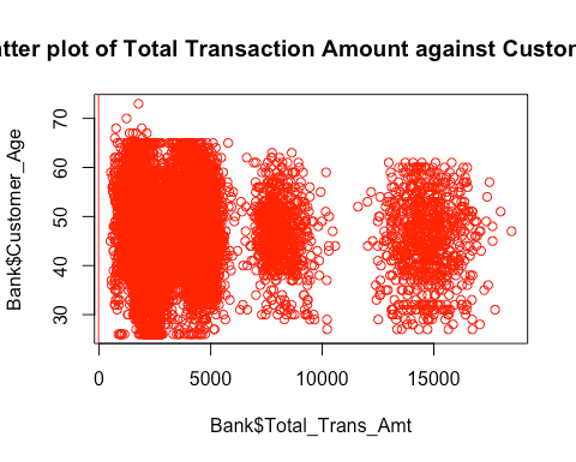

plot(Bank$Total_Trans_Amt,Bank$Customer_Age, main = "Scatter plot of Total Transaction Amount against Customer Age", col = "red")

abline(Bank$Total_Trans_Amt,Bank$Customer_Age, col = "red")

Inference: The result of the correlation test shows that there is a positive correlation between the credit limit and the total transaction amount which makes sense in the real world as it is expected that as the credit limit increases, the total transaction amount would increase because there’s more to spend. Also, there is a very weak negative correlation between the customer age and the total transaction limit. But the dot plots show that there is no clear linear pattern between response variables (i.e no multi-collinearity) and the target variable so more tests have to be done to conclude. Since, there is no major correlation between the response variables, I will go ahead to use both of them.

PROBLEM STATEMENT: The bank is curious to know if customers’ credit limits and customer’s age can determine their total transaction amounts. AIM: Using a linear model to see whether the credit limit and customer age determine the the total transaction amount, to see if the credit limit and age play a role in the usage of the cards.

ASSUMPTIONS:

- Null Hypothesis (H0): The credit limit and customer age do not contribute statistically to determine the total transaction amount

- Alternate Hypothesis (H1): The credit limit and customer age contribute statistically to determine the total transaction amount

Reg <- lm(Bank$Total_Trans_Am ~ Bank$Credit_Limit+Bank$Customer_Age)

summary(Reg)

Output

Call:

lm(formula = Bank$Total_Trans_Am ~ Bank$Credit_Limit + Bank$Customer_Age)

Residuals: Min 1Q Median 3Q Max

-5377.1 -2169.7 -494.4 651.1 13997.3

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 4.770e+03 1.973e+02 24.175 < 2e-16 ***

Bank$Credit_Limit 6.423e-02 3.655e-03 17.571 < 2e-16 ***

Bank$Customer_Age -1.986e+01 4.144e+00 -4.793 1.67e-06 ***

Signif. codes: 0 ‘*’ 0.001 ‘’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ‘ 1

Residual standard error: 3343 on 10124 degrees of freedom

Multiple R-squared: 0.03169, Adjusted R-squared: 0.0315

F-statistic: 165.7 on 2 and 10124 DF, p-value: < 2.2e-16

RESULTS: The linear model gives a range of results, and they are as follows: The intercept is 4.770e+03, the credit limit estimate is 6.423e-02 and the p-value is < 2.2e-16 while the customer age estimate is -1.986e+01 and the p-value is 1.67e-06. Inference: The null hypothesis should clearly be rejected because the p-value<2.2e-16 which is way less than the 0.001 significance level. i.e I do not have enough evidence to say that the credit limit and customer age are not statistically significant determinants for the total transaction amount.

CHI-SQUARE TEST

PROBLEM STATEMENT: Is there an independence between the attrition flag and the marital status of the customers? AIM: Using a Chi-squared test to see if there is an independence between the attrition flag and the marital status of the customers.

ASSUMPTIONS:

- Null Hypothesis (H0): There is an independence between the marital status and attrition flag of customers.

- Alternate Hypothesis (H1): There is no independence between the marital status and attrition flag of customers.

# Creating a contingency table

contingency_table <- table(Bank$Attrition_Flag, Bank$Marital_Status)

head(contingency_table)

Output

| Divorced | Married | Single | Unknown | |

|---|---|---|---|---|

| Attrited Customer | 121 | 709 | 668 | 129 |

| Existing Customer | 627 | 3978 | 3275 | 620 |

#Checking for the expected frequencies

expectedFreq <- chisq.test(contingency_table)$expected

print(expectedFreq)

Output

| Divorced | Married | Single | Unknown | |

|---|---|---|---|---|

| Attrited Customer | 120.1734 | 753.0117 | 633.4809 | 120.3341 |

| Existing Customer | 627.8266 | 3933.9883 | 3309.5191 | 628.6659 |

Since the expected frequencies are greater than 5, I will go ahead to test for independence.

# Performing the chi-squared test

chisq.test(contingency_table, confint(level = 0.95))

Output

Pearson’s Chi-squared test

data: contingency_table

X-squared = 6.0561, df = 3, p-value = 0.1089

RESULTS: The Chi-squared testgives a range of results, and they are as follows: The x-squared value is 6.0561 and the p-value is 0.1089. Inference: Since the p-value is 0.1089 which is greater than the significance level 0.05, the null hypothesis Ho, that there an independence between the marital status and attrition flag of customers, cannot be rejected due to lack of evidence.

LOGISTIC REGRESSION

PROBLEM STATEMENT: Are the customer age, total transaction amount, gender, card category and the credit limit all statistically significant in predicting the log odds of a customer’s attrition?

ASSUMPTIONS

- Null Hypothesis (H0): The customer age, total transaction amount, gender, card category and credit limit are not statistically significant in predicting the log odds of a customer’s attrition.

- Alternate Hypothesis (H1): The customer age, total transaction amount, gender, card category and credit limit are all statistically significant in predicting the log odds of a customer’s attrition.

# Specifying the categorical variables

Genderf <- factor(Bank$Gender, levels = c("M", "F"))

Card_Categoryf <- factor(Bank$Card_Category, levels = c("Blue", "Gold", "Platinum", "Silver"))

Attrition_Flagf <- factor(Bank$Attrition_Flag, levels = c("Existing Customer", "Attrited Customer"))

# Logistic regression model

fit <- glm(Attrition_Flagf ~ Customer_Age + Total_Trans_Amt + Genderf + Card_Categoryf + Credit_Limit,

data = Bank,

family = "binomial")

# Summary of the logistic regression model

summary(fit)

Output

Call: glm(formula = Attrition_Flagf ~ Customer_Age + Total_Trans_Amt + Genderf + Card_Categoryf + Credit_Limit, family = “binomial”, data = Bank)

Deviance Residuals:

Min 1Q Median 3Q Max

-1.3999 -0.6362 -0.5507 -0.3344 2.7004

Coefficients:

Estimate Std. Error z value Pr(>|z|)

(Intercept) -1.027e+00 1.750e-01 -5.871 4.33e-09 ***

Customer_Age 3.072e-03 3.368e-03 0.912 0.36165

Total_Trans_Amt -2.575e-04 1.553e-05 -16.576 < 2e-16 ***

GenderfF 2.770e-01 6.273e-02 4.416 1.01e-05 ***

Card_CategoryfGold 8.787e-01 2.749e-01 3.196 0.00139 **

Card_CategoryfPlatinum 1.608e+00 5.932e-01 2.711 0.00671 **

Card_CategoryfSilver 2.949e-01 1.465e-01 2.013 0.04414 *

Credit_Limit -2.407e-07 4.134e-06 -0.058 0.95358

Signif. codes: 0 ‘* 0.001 ‘’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ‘ 1

(Dispersion parameter for binomial family taken to be 1)

Null deviance: 8927.2 on 10126 degrees of freedom Residual deviance: 8480.0 on 10119 degrees of freedom AIC: 8496

Number of Fisher Scoring iterations: 6

RESULTS: The logistic regression gives a range of results, and they are as follows: The intercept is -1.025e+00 at the 0.001 significance level, the p-value of customer age is 0.485021 at the 0.001 significance level, the p-value of the total transaction amount is < 2.2e-16 at the 0.001 significance level, the p-value of gender compared to female (reference group is male) is 0.000319 at the 0.001 significance level, the p-value of credit limit is 0.916083 at the 0.001 significance level, the p-value of the card category compared to gold (reference group is blue) is 0.021446 at the 0.05 significance level, the p-value of card category compared to platinum (reference group is blue) is 0.001027 at the 0.01 significance level and the p-value of card category compared to silver (reference group is blue) is 0.012628 at the 0.05 significance level.

Inference: Since p-value = 0.485>0.001, the result shows that the age of the customers has no statistically significant effect on the chance of attrition. On the other hand, total transaction amount stands out as a critical component, showing a highly significant negative connection (p-value < 0.001) with attrition, suggesting that larger transaction amounts are linked to reduced attrition odds. The log-odds of attrition are significantly higher for female gender than for male reference group, with a highly significant p-value of less than 0.001 and a positive coefficient of 0.2557. Furthermore, compared to the reference category (Blue), the card categories Gold, Platinum, and Silver show positive and significant coefficients, indicating higher log-odds of attrition. On the other hand, credit limit does not show a statistically significant effect on the log-odds of attrition (p-value = 0.916). Overall, these findings shed light on the influential factors contributing to customer attrition within the dataset.

Importing the Video Game Sales dataset

VIDEO GAME SALES DATASET:

The dataset encapsulates a wealth of information about video game sales, spanning continents, genres, platforms, and publishers. From the amount of sales in North America and Europe to the global sales figure, this dataset provides a holistic view of the gaming landscape.

library(readr)

Game <- read.csv("VidGameSaless.csv")

#Checking the contents of the data

head(Game)

Output

| Rank | Name | Platform | Year | Genre | Publisher | NA_Sales | EU_Sales | JP_Sales | Other_Sales | Global_Sales |

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Wii Sports | Wii | 2006 | Sports | Nintendo | 41.49 | 29.02 | 3.77 | 8.46 | 82.74 |

| 2 | Super Mario Bros. | NES | 1985 | Platform | Nintendo | 29.08 | 3.58 | 6.81 | 0.77 | 40.24 |

| 3 | Mario Kart Wii | Wii | 2008 | Racing | Nintendo | 15.85 | 12.88 | 3.79 | 3.31 | 35.82 |

| 4 | Wii Sports Resort | Wii | 2009 | Sports | Nintendo | 15.75 | 11.01 | 3.28 | 2.96 | 33.00 |

| 5 | Pokemon Red/Pokemon Blue | GB | 1996 | Role-Playing | Nintendo | 11.27 | 8.89 | 10.22 | 1.00 | 31.37 |

| 6 | Tetris | GB | 1989 | Puzzle | Nintendo | 23.20 | 2.26 | 4.22 | 0.58 | 30.26 |

Note that the Sales amounts are in millions.

#Checking the summary of the dataset

summary(Game)

Output

| Statistic | Rank | Name | Platform | Year | Genre | Publisher | NA_Sales | EU_Sales | JP_Sales | Other_Sales | Global_Sales |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Min. | 1.0 | Length:2624 | Length:2624 | Length:2624 | Length:2624 | Length:2624 | 0.000 | 0.0000 | 0.000 | 0.0000 | 0.790 |

| 1st Qu. | 657.8 | Class :character | Class :character | Class :character | Class :character | Class :character | 0.470 | 0.2100 | 0.000 | 0.0700 | 1.050 |

| Median | 1313.5 | Mode :character | Mode :character | Mode :character | Mode :character | Mode :character | 0.750 | 0.4200 | 0.020 | 0.1200 | 1.460 |

| Mean | 1313.3 | 1.155 | 0.6857 | 0.298 | 0.2215 | 2.360 | |||||

| 3rd Qu. | 1969.2 | 1.262 | 0.7625 | 0.260 | 0.2200 | 2.382 | |||||

| Max. | 2625.0 | 41.490 | 29.0200 | 10.220 | 10.5700 | 82.740 |

The data set has a total of 11 variables and 2,624 observations. This suggests that the normality checks using a Shapiro Test will be applicable since the sample size is < 3,000.

WILCOXON RANK SUM TEST

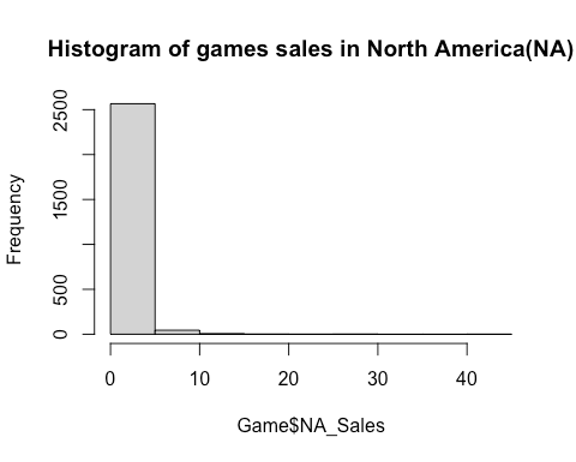

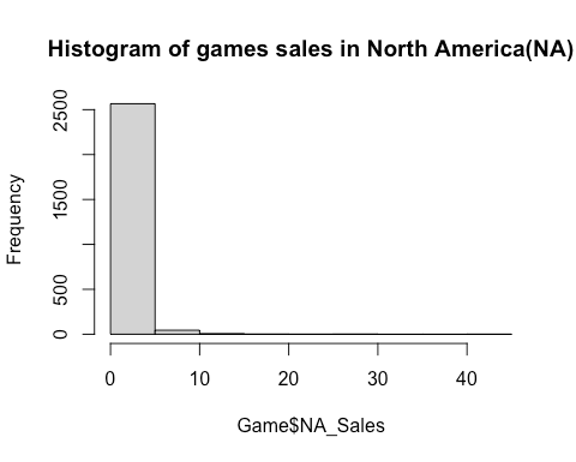

PROBLEM STATEMENT: Are the video game sales in North America (NA) and Europe (EU) equal? EXPLORATORY DATA ANALYSIS: A visual representation of the NA sales and EU sales

hist(Game$NA_Sales, main = "Histogram of games sales in North America(NA)")

Output

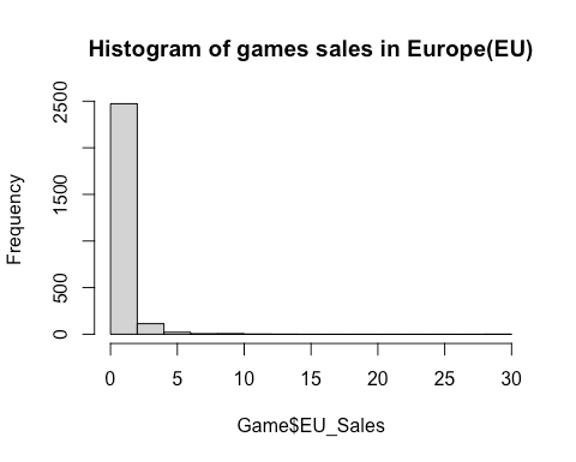

hist(Game$EU_Sales, main = "Histogram of games sales in Europe(EU)")

Output

Inference: From the histograms, it is clear that the distributions of the sales in both NA and EU are not normal but right skewed. Using Shapiro test and Q-Q plots to check the normality of the NA sales and EU sales.

shapiro.test(Game$NA_Sales)

Output

Shapiro-Wilk normality test

data: Game$NA_Sales

W = 0.42281, p-value < 2.2e-16

shapiro.test(Game$EU_Sales)

Shapiro-Wilk normality test

data: Game$EU_Sales

W = 0.46304, p-value < 2.2e-16

qqnorm(Game$NA_Sales, col="purple", main = "Q-Q Plot of NA Sales")

qqline(Game$NA_Sales, col="black")

Output

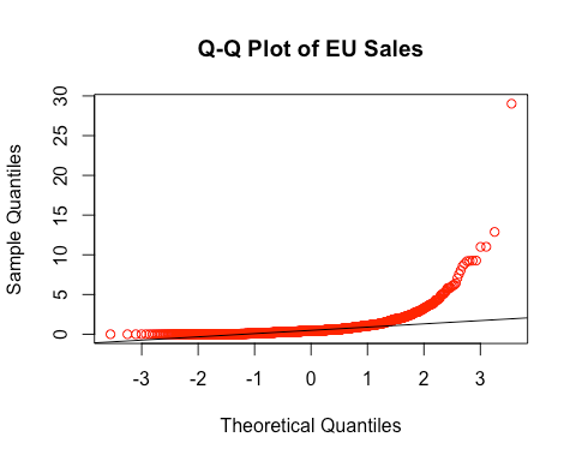

qqnorm(Game$EU_Sales, col="red",main = "Q-Q Plot of EU Sales")

qqline(Game$EU_Sales, col="black")

Output

Inference: Since the p-values of both tests show that p < the significance level 0.05 and the Q-Q plots deviating from a straight line, we conclude that the NA sales and EU sales are not normally distributed, therefore being appropriate for a non-parametric test.

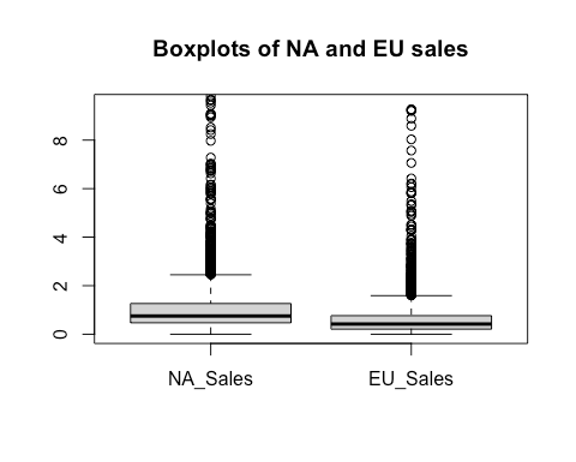

Box plots to check the distribution of sales in NA and EU

boxplot((Game$NA_Sales), (Game$EU_Sales), names = c("NA_Sales", "EU_Sales"),ylim = c(0, 9.5), main = "Boxplots of NA and EU sales")

Output

Inference: From the box plots, it is obvious that the median of the NA sales are greater than that of the EU sales, which could imply that the mean of NA sales could be greater too. AIM: Using a Wilcoxon rank-sum test to check the null hypothesis that the video game sales in NA and EU are equal. ASSUMPTIONS:

- Null Hypothesis (H0): The video game sales in NA and EU are equal.

- _Alternate Hypothesis (H1): The video game sales in NA are greater than those in EU.

wilcox.test(Game$NA_Sales,Game$EU_Sales,alternative = "greater",conf.int = TRUE)

Output

Wilcoxon rank sum test with continuity correction

data: Game$NA_Sales and Game$EU_Sales

W = 4679332, p-value < 2.2e-16

alternative hypothesis: true location shift is greater than 0

95 percent confidence interval:

0.290025 Inf

sample estimates:

difference in location

0.3100372

RESULTS: The Wilcoxon Rank Sum test gives a W-statistic of 4679332 in a confidence interval of -0.290025 to 0.290025 and a p-value which is <2.2e-16 at the 0.05 significance level. Inference: Since the p-value < the significance level 0.05, the null hypothesis is rejected. Suggesting that there is evidence that the sales in North America are greater than the sales in Europe.

KRUSKALL-WALLIS TEST

PROBLEM STATEMENT: Is there a significant difference in the global sales from 2011 to 2014? EXPLORATORY DATA ANALYSIS: Normality tests on the global sales from 2011 to 2014

ASSUMPTIONS:

- Null Hypothesis (H0): Global sales across the years 2011, 2012, 2013, and 2014 are normally distributed

- Alternative Hypothesis (H1): Global sales across the years 2011, 2012, 2013, and 2014 are not normally distributed

# Filtering data for the years 2011 to 2014

subset_data <- subset(Game, Year %in% c(2011, 2012, 2013, 2014))

# Creating an empty vector to store p-values

p_values <- numeric()

# Looping through each year and perform the Shapiro-Wilk test

for (year in c(2011, 2012, 2013, 2014)) {

subset_sales <- subset_data$Global_Sales[subset_data$Year == year]

shapiro_result <- shapiro.test(subset_sales)

p_values <- c(p_values, shapiro_result$p.value)

}

# Creating a data frame with the results

results_df <- data.frame(Year = c(2011, 2012, 2013, 2014), p_value = p_values)

# Displaying the results

print(results_df)

Output

| Year | p_value |

|---|---|

| 2011 | 1.287281e-17 |

| 2012 | 6.394927e-17 |

| 2013 | 1.258310e-17 |

| 2014 | 2.551033e-12 |

Inference: From the results, the p values for all the year are < significance level of 0.05 and thus, the null hypothesis that they are normally distributed is rejected.

AIM: I aim to use a Kruskall-Wallis test to check if there is a significant difference in global sales from 2011 to 2014.

ASSUMPTIONS:

- Null Hypothesis (H0): There is no difference in global sales across the years 2011, 2012, 2013, and 2014.

- Alternative Hypothesis (H1): There is a significant difference in global sales across at least one of the years.

kruskal.test(Global_Sales ~ Year, data = subset_data)

Output

Kruskal-Wallis rank sum test

data: Global_Sales by Year

Kruskal-Wallis chi-squared = 7.3606, df = 3, p-value = 0.06125

RESULTS: The Kruskal-Wallis test gives that the Kruskal-Wallis chi-squared is 7.3606 and a p-value which is 0.06125 at the 0.05 significance level.

Inference: In this case, the p-value is 0.06125, which is slightly larger than the common significance level of 0.05. Therefore, I choose not to reject the null hypothesis at the 0.05 significance level.

REFERENCES

- Chauhan, A. (2022) Credit card customers prediction, Kaggle. Available at: https://www.kaggle.com/datasets/whenamancodes/credit-card-customers-prediction (Accessed: 11 November 2023).

- GregorySmith (2016) Video game sales, Kaggle. Available at: https://www.kaggle.com/datasets/gregorut/videogamesales (Accessed: 11 November 2023).